The situation with coronavirus, officially Covid-19, is changing daily. The future situation is unknown but there are resources and advice available which will change as the situation changes.

Businesses adversely impacted by the Omicron variant and government restrictions announced on 8th December are eligible to apply for the Omicron Additional Restrictions Grant. This is a one-off discretionary grant of £1,000 for businesses with third-party fixed term costs such as rent or £500 for businesses without third-party fixed term costs.

Businesses eligible for the Omicron Hospitality and Leisure Grant cannot apply.

You must apply for this grant by 28th February via the form on the Hart District Council website here: https://www.hart.gov.uk/omicron-additional-restrictions-grant

Updated 4th January 2022

Omicron Hospitality and Leisure Grant (announced 21st December)

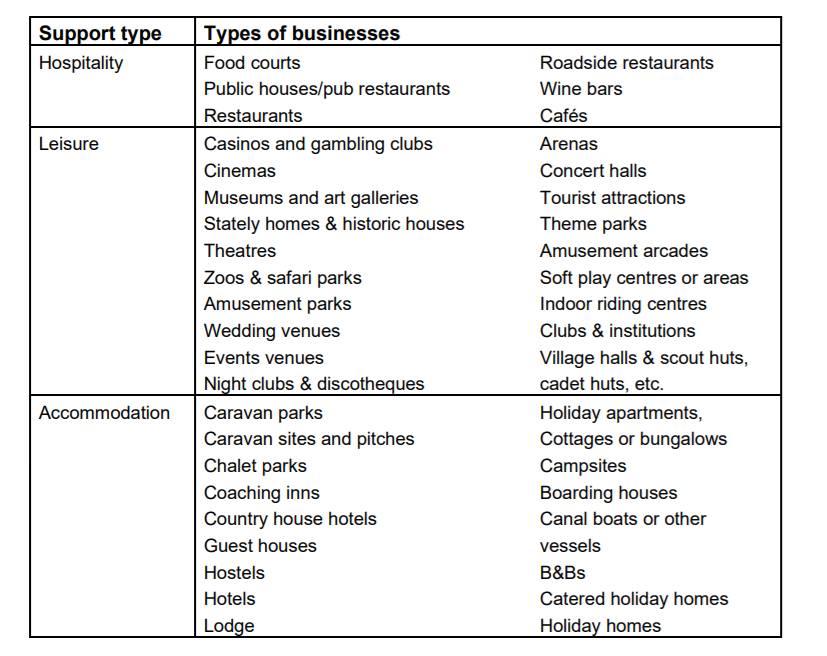

This grant announced by the government is designed to support hospitality, leisure and accommodation business premises (see image for businesses eligible).

Grants are

Eligible businesses

Businesses will need to apply for the grants via the Hart District Council website here: https://www.hart.gov.uk/grants-funding (applications not open when this page was updated – 13th January)

Updated 10th December 2021

From Friday 10 December

From Monday 13 December

From Wednesday 15 December

Working Safely Guidance for businesses

The government’s Working Safely during Coronavirus guidance will be updated on the government website here. At the time of writing these have not been updated.

Employers will still have a legal duty to manage risks to those affected by their business and are expected to carry out a health and safety risk assessment which includes the risk of COVID-19 and how those risks will be mitigated. The could include

Protections remaining in place:

VAT reduction for certain sectors

The rate of VAT for hospitality, hotel and holiday accommodation and admissions to certain attractions has been amended by the government as follows:

Find out more here.

Business Rates

Businesses in the following sectors are eligible for business rates retail discount:

The Business Rates retail discount in England is as follows:

Peer Network session for hospitality, retail and leisure

Register for a free webinar on 20th January to find out more: https://events.weareumi.co.uk/…/registration/Site/Register

NHS COVID-19 app and QR Codes

You can create your personalised QR poster for people to scan and check in here: https://www.gov.uk/create-coronavirus-qr-poster

Covid-19 Secure guidelines for safe working

Updated 13th January 2022

Specific guidance is available on the government website for the following sectors:

Read the guidance here.

Financial support for businesses during coronavirus (COVID-19)

Updated 13th January 2022

There is a summary of the financial support you can get for your business on the government website here: https://www.gov.uk/government/collections/financial-support-for-businesses-during-coronavirus-covid-19

FLEET BID SUPPORT

Our Back in Business car packs include posters, hand sanitiser, floor and window stickers. On our website we can create a dedicated page for any business who does not have an e-commerce operation but would like to have some products available online.

You can also access information on suppliers of protective equipment here.

To find out more or to get involved email us.

Government Grants from Hart District Council

Hart District Council have opened applications for their Extended Restrictions Grant scheme.

These are designed to support businesses who have been adversely affected by the government extending restrictions beyond 21st June. This includes:

Hart District Council have emailed businesses they believe are eligible and payments will be made automatically starting 12th July.

The closing date for applications is 22nd July at 5pm. Apply here:

https://www.hart.gov.uk/grants-funding

Take Five Business Toolkit

Take Five is a national campaign led by the finance industry with advice to preventable financial fraud.

Download their toolkit here.

Hampshire County Council is leading the Local Outbreak Control Planning and together with District Council Chief Executives and Environmental Health Officers and have set up a business information page which aims to support businesses in Hampshire respond to a case or outbreak of coronavirus. The page includes: